irs child tax credit customer service

The child tax credit is 2000 for. The tax agency said it has taken major steps ahead of the 2023 tax season to help it avoid many of the customer service problems that have plagued it the last couple of years.

Child Tax Credit Payment Schedule Here S When To Expect Checks Kare11 Com

For more details see Topic H.

. The advance payments of the Child Tax Credit are well underway with the third payment to be deposited Sept. These updated FAQs were released to the public in Fact Sheet 2022-32PDF July 14 2022. Reconciling your Advance Child Tax Credit Payments on your 2021 Tax Return on the IRS website.

Make sure you have the following information. 15 but the millions of payments the IRS has sent out have not. The IRS maintains a range of other phone numbers for departments and services that deal with specific issues.

The first option is to call although wait times are reportedly averaging up to close to half an hour with the IRS having to field calls regarding stimulus checks and other tax. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax. For all other tax law inquiries visit the Interactive Tax Assistant on irsgov.

IRS Child Tax Credit Services. The IRS skipped about 37 billion in advance child tax credit payments for 41 million eligible households but sent more than 11 billion to 15 million filers. This one-pager lists locations and addresses of IRS Tax Assistance Centers TAC nationwide where the IRS will host AdvCTC Child Tax Credit Free.

In that case contacting the IRS by phone can get you the help you need. 15 but the millions of payments the IRS has sent out have not. The advance payments of the Child Tax Credit are well underway with the third payment to be deposited Sept.

Child Tax Credit for 2022. 15 but the millions of payments the IRS has sent out have not. Five Myths About Federal Tax Returns Debunked.

Find answers about advance payments of the 2021 Child Tax Credit. The Internal Revenue Service erroneously sent more than 1 billion in child tax credit payments last year to millions of Americans who werent eligible for the free cash an. Top Tips for Painless Tax Prep Find.

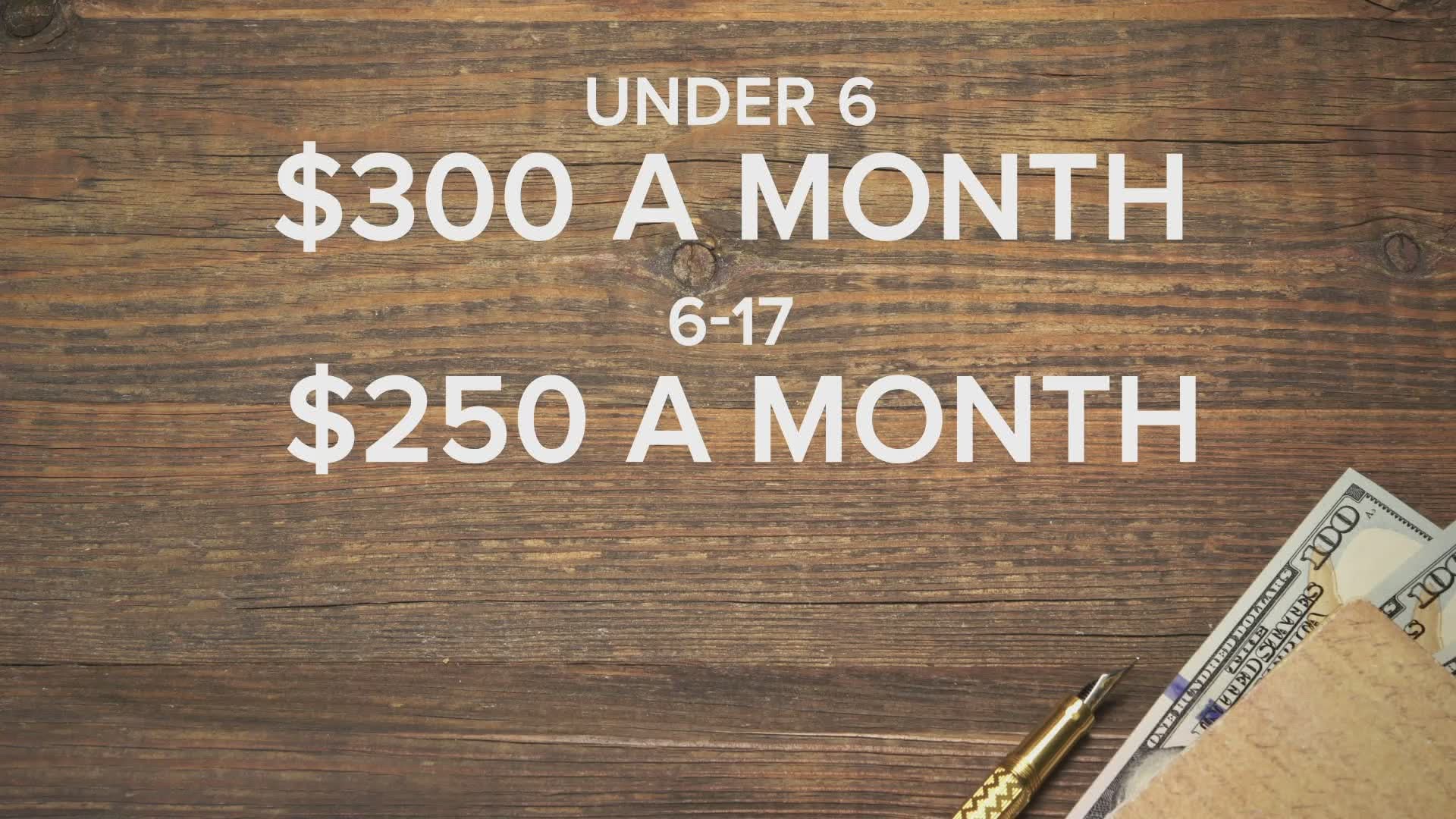

It is a tax law resource that takes you through a series of questions and provides you with responses. Eligible families will receive advance ChildTaxCredit payments of up to 300 for each child younger than age 6 and up to 250 for each qualifying child ages six to 17. WASHINGTON AP The IRS said Thursday it has hired an additional 4000 customer service representatives who are being trained to answer taxpayer questions during.

If the child tax credit tool doesnt provide the answer you anticipate it might be best to call the Internal Revenue Service. To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment. The advance payments of the Child Tax Credit are well underway with the third payment to be deposited Sept.

Since the child tax credit questions and troubles are related to. Try one of these numbers if any of them makes sense for your.

The Irs Wants You To Get Your Stimulus Check And Child Tax Credit Cash If You Haven T Claimed It Here S What To Look For Marketwatch

Irs Opens Non Filer Portal For Child Tax Credit Registration

Telephone Assistance Internal Revenue Service

Child Tax Credit Advance Monthly Payments Explained Donovan

Irs Failed To Send Child Tax Credit To Millions Audit Ktla

Having Issue Obtaining Your Irs Child Tax Credit Franklin County

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Irs Beware Of Scammers Trying To Cash In On Child Tax Credit Payments

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Irs Adds Change Of Address Capability To Child Tax Credit Portal Accounting Today

Child Tax Credit Irs Mails Letters To Taxpayers About Advanced Payments Kron4

Important Child Tax Credit Form Coming For Families In The Mail Kare11 Com

Child Tax Credit 2022 You Might Have Received An Incorrect 6419 Letter Irs Warns Lee Daily

Want More Child Tax Credit Money File Your 2021 Taxes Money

Tax Tip Tool Available To Track Your Advance Child Tax Credit Payments Taxpayer Advocate Service

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Kokh

2021 Child Tax Credit Advanced Payment Option Tas

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

The Irs Wants You To Get Your Stimulus Check And Child Tax Credit Cash If You Haven T Claimed It Here S What To Look For Marketwatch

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block